Optimizing price, maximizing revenue

Published:

Setting a right price of products/services is one of the most important decisions a business can make. Under-pricing (and over-pricing) can hurt a company’s bottom line. Two determinants/indicators of business revenue are product prices and quantity sold. At higher price revenue is expected to be higher, if quantity sold is constant. However we know from our everyday experience that price and quantity are inversely related – as the price of something goes up, people show less intent to buy it.

The opposite is also true, that is, as price goes down, sales go up (that’s why we big “sale” events in shopping malls round the year). But that doesn’t mean that the revenue will always go up.

So an important question to ask is: if higher price means sales down and at lower price revenue goes down then where is the sweet spot, the right price, that maximizes revenue? With a simple example we’ll examine how to optimization price to maximize revenue and profit.

Import libraries

from __future__ import print_function

import numpy as np

import pandas as pd

from pandas import DataFrame

import matplotlib.pyplot as plt

import seaborn as sns

import statsmodels.api as sm

from statsmodels.compat import lzip

from statsmodels.formula.api import ols

%matplotlib inline

Data

Data in this analysis comes from here [Susan Li has a nice blog post about price elasticity of demand (i.e. sensitivity of demand to change in price) explained using the same dataset]. This is a time series, quarterly dataset of beef sales (quantity) and corresponding price.

This dataset will be used first to find price elasticity of demand and then to find at what price the profit is maximized.

# Load data

beef = pd.read_csv('https://raw.githubusercontent.com/susanli2016/Machine-Learning-with-Python/master/beef.csv')

# View first few rows

beef.tail(5)

| Year | Quarter | Quantity | Price | |

|---|---|---|---|---|

| 86 | 1998 | 3 | 17.5085 | 277.3667 |

| 87 | 1998 | 4 | 16.6475 | 279.5333 |

| 88 | 1999 | 1 | 16.6785 | 278.0000 |

| 89 | 1999 | 2 | 17.7635 | 284.7667 |

| 90 | 1999 | 3 | 17.6689 | 289.2333 |

Step 1: Define the profit function

We know,

profit = revenue - cost (1)

We also know,

revenue = qt_demanded * price (2)

Therefore,

profit = qt_demanded * price - cost (3)

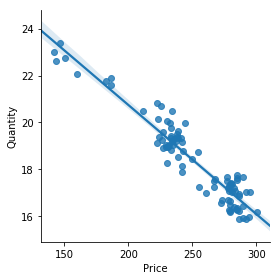

Step 2: Define the demand function

Assuming that the cost is constant, we first need to estblish the relationship between qt_demanded and price:

qt_demanded = f(price) (4)

This demand function can be estimated based on hitorical price and corresponding sales data.

# demand curve estimation

sns.lmplot( x="Price", y="Quantity", data=beef, fit_reg=True, size=4)

<seaborn.axisgrid.FacetGrid at 0x195b918df60>

# fit OLS model

model = ols("Quantity ~ Price", data=beef).fit()

# print model summary

print(model.summary())

OLS Regression Results

==============================================================================

Dep. Variable: Quantity R-squared: 0.901

Model: OLS Adj. R-squared: 0.900

Method: Least Squares F-statistic: 811.2

Date: Thu, 18 Apr 2019 Prob (F-statistic): 1.69e-46

Time: 15:51:26 Log-Likelihood: -77.493

No. Observations: 91 AIC: 159.0

Df Residuals: 89 BIC: 164.0

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 30.0515 0.413 72.701 0.000 29.230 30.873

Price -0.0465 0.002 -28.482 0.000 -0.050 -0.043

==============================================================================

Omnibus: 3.453 Durbin-Watson: 1.533

Prob(Omnibus): 0.178 Jarque-Bera (JB): 2.460

Skew: 0.237 Prob(JB): 0.292

Kurtosis: 2.349 Cond. No. 1.74e+03

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.74e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

Step 3: Parameterize the profit function in step 1

The demand function with parameter values coming from the above regression:

qt_demanded=30.05-0.0465*price (5) Therefore, the profit function in equation (3) becomes

profit = (30.05-0.0465*price)*price - cost (6)

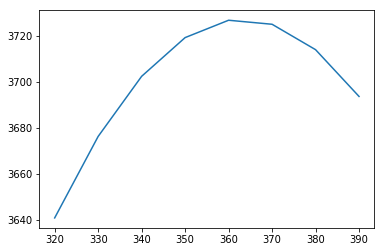

Step 4: Finding the price that maximizes profit

Price = [320, 330,340,350, 360, 370, 380, 390] # a range of diffferent prices to find the optimum one

Cost = 80 # a fixed cost in this case

Revenue = []

for i in Price:

quantity_demanded=30.05-0.0465*i

Revenue.append((i-cost)*quantity_demanded) # profit function

# create data frame of price and revenue

profit=pd.DataFrame({"Price": Price, "Revenue": Revenue})

#plot revenue against price

plt.plot(profit["Price"], profit["Revenue"])

[<matplotlib.lines.Line2D at 0x195ba1cf9b0>]

# price at which the revenue is maximum

profit[profit['Revenue'] == profit['Revenue'].max()]

#profit.loc[profit['Revenue'].idxmax()]

| Price | Revenue | |

|---|---|---|

| 4 | 360 | 3726.8 |

So USD 360 is the price, from a lis tof prices, at which the profit is maximized. We used a price interval of USD 10, this could be any number that gives the right outcome.